What Makes Vytl Health Plans Different?

People come in all shapes and sizes, are your health status is UNIQUE to you - whether that's because of where you're from, your lifestyle, or your family history. We don't try to force you into a standard health plan that 'almost' fits. We let you chose the level of benefits you want, and help you find a price that works for you. Want to have more cover for your international trips? - You got it! Just want to cover the basics? You got it! Want to help cover the costs of pet care when you're in hospital? - Yep, you've got that too!

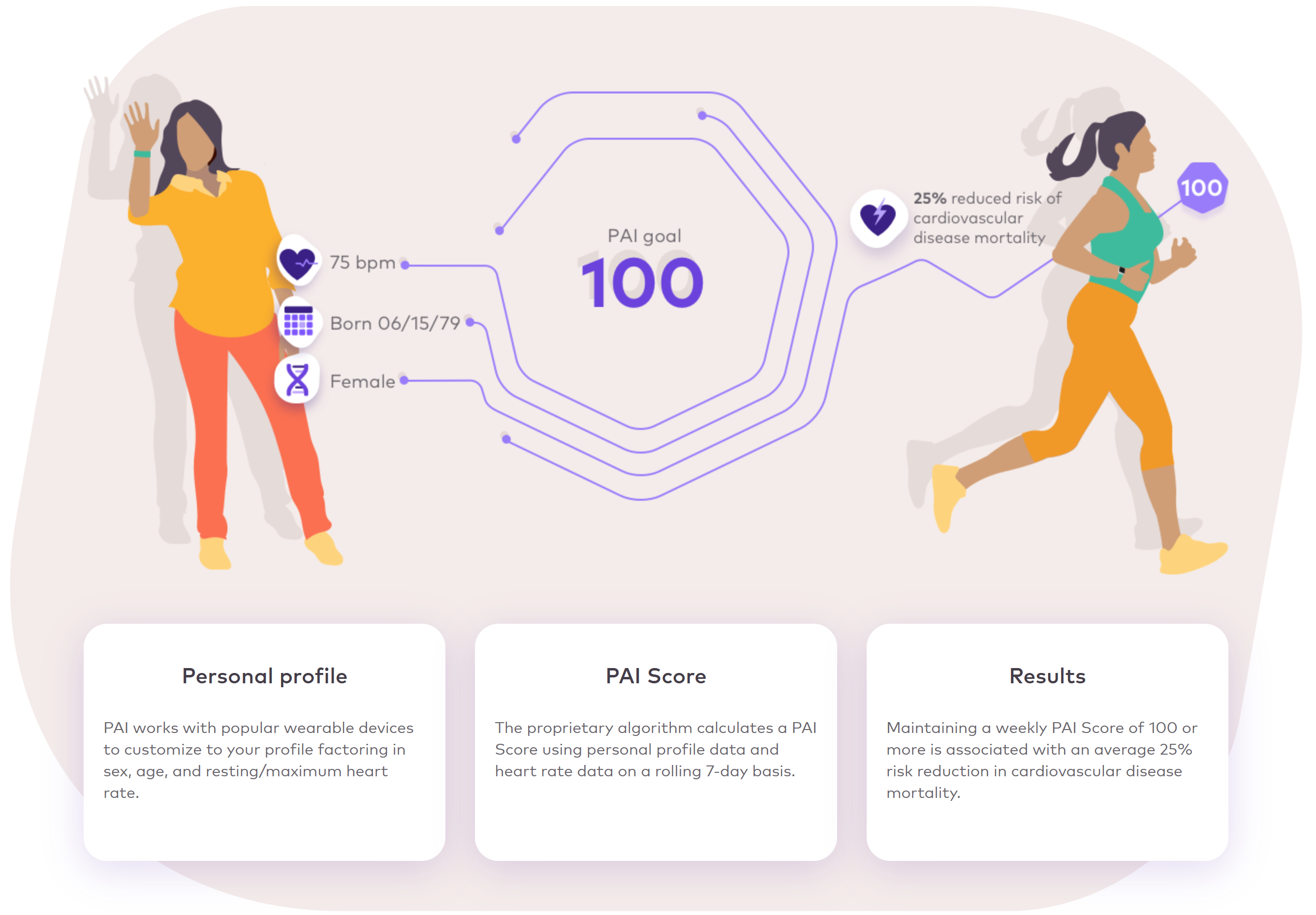

What's more - you get REWARDED for taking the time to stay healthy! We see the effort it takes to make a positive difference in your health - and we believe that should be encouraged and rewarded! Healthy people make less claims on their insurance - and we believe that should be money in your pocket - not ours.

To help you get there - we have BUILT IN COVER for preventative care, and twice a year you have a FREE consultation with our Vytl Doctor to help you reach your health and wellness goals.